October 17 2024

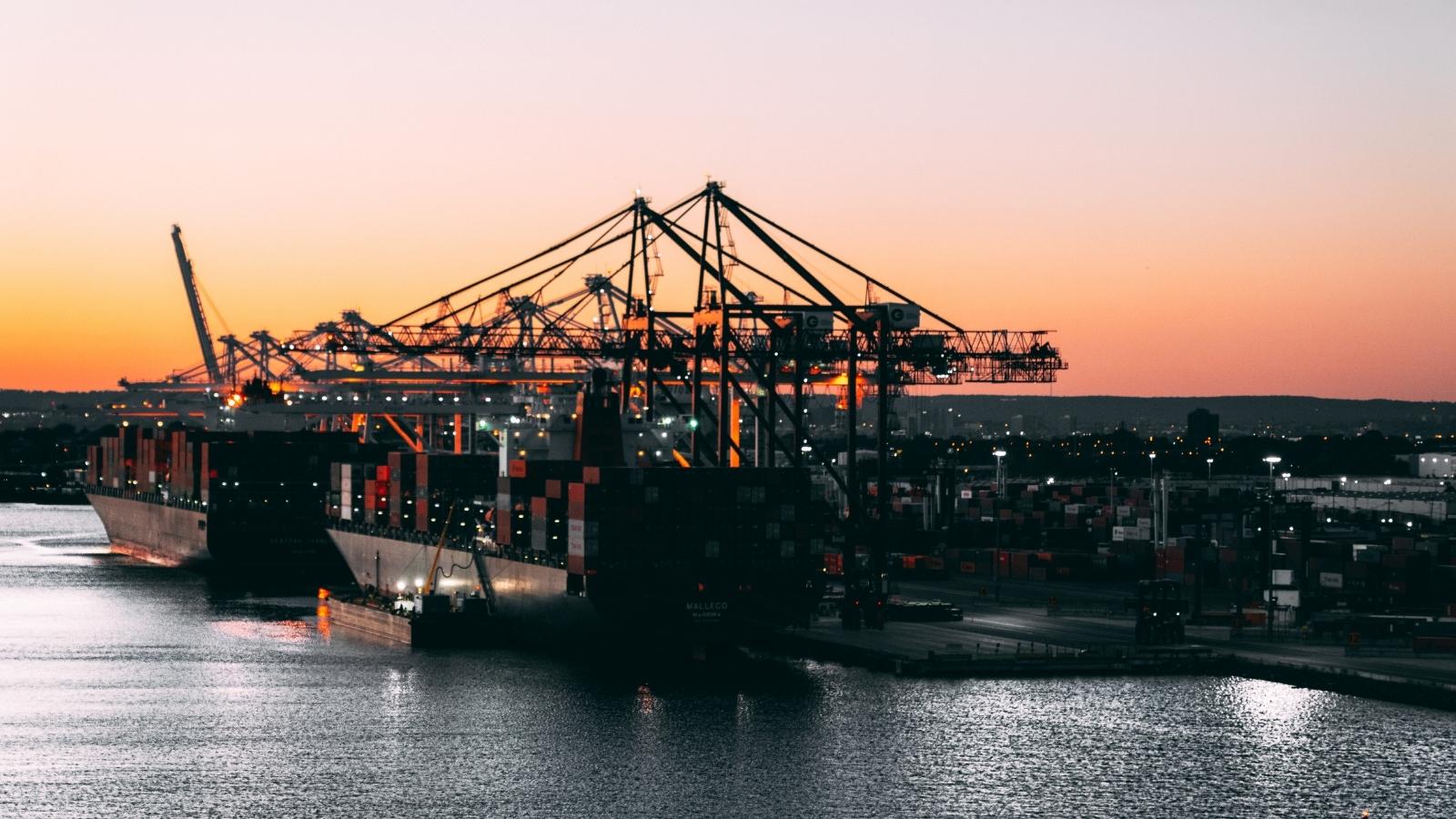

Retailers Against Smuggling (RAS) welcomes this week’s seizure by Revenue, of 8 million cigarettes in County Meath, as pictured above. This most recent seizure, with a retail value of almost 7.2 million, and a loss to the Exchequer of 5.7 million is the 33rd major illegal cigarette seizure of 2024. The total number of illegal cigarette seizures for last year was 31. RAS, an organisation which represents over 3,000 retailers across Ireland are urgently calling on the government to reduce or freeze taxes which impact the price of consumer goods, including a freeze on tobacco excise. Ireland has one of the highest rates of illegal tobacco trade in Europe. Illegal tobacco poses great risks to consumers and businesses, undermines anti-smoking and public health campaigns, is a significant source of organised crime and violates state rules on manufacturing, distribution and sale.

So far this year, 85.4 million cigarettes have been seized by Revenue, with a total retail value of 81.7 million euros, a loss of 63 million euro to the Irish Exchequer. In terms of losses to the Irish Exchequer, August figures took this year’s figures past last year’s total. It is only October and with three remaining in the year, already the loss to the Exchequer is 18 million greater than last year. According to Tax Strategy Group papers 2 which were recently published ahead of the Budget 2025, an increase of 50 cents in excise on a pack of 20 cigarettes would theoretically bring in €40.6 million. However, the Tax Strategy Group papers also note the notional loss to the exchequer from non-Irish duty paid cigarettes and illicit cigarettes was approximately €422 million in 2023.

Retailers Against Smuggling was extremely disappointed with the Government’s decision to increase excise on tobacco in Budget 2025, as RAS believes this excessive excise increase represents a big win

for illegal tobacco sellers and represents a further blow to legitimate Irish retailers. Government is continuing to ignore the increasing levels of illicit tobacco products in Ireland, with Revenue finding that

the last two consecutive years had the highest level of illicit cigarettes on record, which is clearly being fuelled by excessive excise hikes.

Retailers across Ireland have for years, been cautioning government that the continual increasing of excise will only fuel illegal cigarettes sales resulting in increasing losses, not gains, to the Irish exchequer.

This has been proven to the case over recent years. A review by RAS of the excise revenue received in the six years 2017-2022, shows that ahead of each budget, the Tax Strategy Group paper estimated over

the six years that there would be cumulative additional receipts totaling €350 million. But, in reality, the actual revenue in that period fell from €1.397 million to €1.005 million, a €392 million decline.

Given the tsunami of cigarette smuggling which has engulfed Ireland in 2024, further excise increase will only exacerbate the losses to the exchequer, while also causing significant loss in sales for legitimate

retailers across Ireland, many of whom are small businesses already struggling.

In terms of operational activities to tackle the illicit trade in tobacco products, robust enforcement plays a central role. This is primarily the task of Revenue. Retailers Against Smuggling (RAS), are also calling on

a pressing need to increase funding in Budget 2025 for resources that will detect illicit market activity including x-ray scanners, airport inspections and sniffer dog units.