September 29, 2025

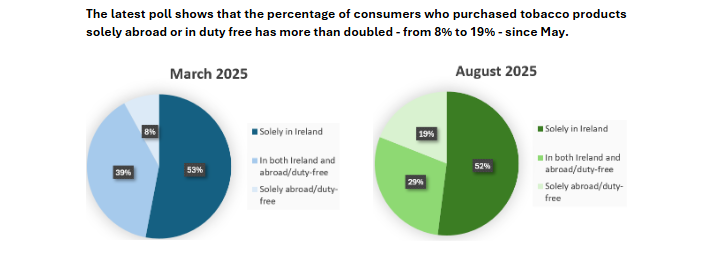

There has been an increase in consumers purchasing tobacco at duty-free or abroad, according to a new poll commissioned by Retailers Against Smuggling (RAS).

In the poll, carried out by Amárach on behalf of RAS, the proportion of customers solely buying tobacco abroad or in duty-free has more than doubled – from 8% in May to 19% in August 2025.

RAS notes that these figures illustrate that Ireland’s Tobacco Products Tax is ‘incentivising’ more consumers to purchase tobacco abroad at a lower cost.

The group added that the lack of enforcement capacity by Revenue means that large volumes of cigarettes coming back to Ireland are in breach of duty-free and travel allowances.

These findings further add to concerns over the scale of untaxed and illicit tobacco already in circulation, which is hurting legitimate retailers and causing a financial loss to the Exchequer.

The Revenue Commissioners’ Illegal Tobacco Product Research Surveys 2024 found that 37% of cigarette packs in circulation carried no Irish stamp duty.

Including roll-your-own tobacco, this represented a tax loss of €934 million in 2024 alone.

RAS warned that, unless effective action is taken against purchases made in excess of travel allowances, smuggling and illicit trade will continue to erode legitimate retail business and undermine Exchequer returns.

Now RAS is calling on the government to take decisive action in Budget 2026 to tackle the sale of illicit tobacco in Ireland.

It suggests that the government introduce a freeze on excise duty on tobacco products, in a bid to halt the growth of Ireland’s untaxed tobacco market, and recruit an additional 250 members of Revenue Commissioner frontier staff to provide a visible and effective deterrent and enforcement capacity at Dublin’s ports and airports.

‘A Direct Blow’

RAS spokesperson Benny Gilsenan commented on the results of the poll, saying, “The poll blatantly shows that Irish consumers are increasingly sourcing tobacco outside the state.

“Every purchase made abroad or in travel retail in excess of legal limits is a direct blow to the bottom line of retailers and the Exchequer, and even more so when these products are sold on the black market.

“It’s time for the government to recognise that the behavioural shift is directly driven by successive excise increases and take meaningful actions to tackle this behavioural shift by consumers while protecting legitimate retailers.”